The Middle East and North Africa (MENA) region is rapidly becoming one of the world’s most dynamic frontiers for entrepreneurship. Over the past decade, governments, investors, and innovators have been working together to diversify economies, digitize industries, and empower a new generation of founders.

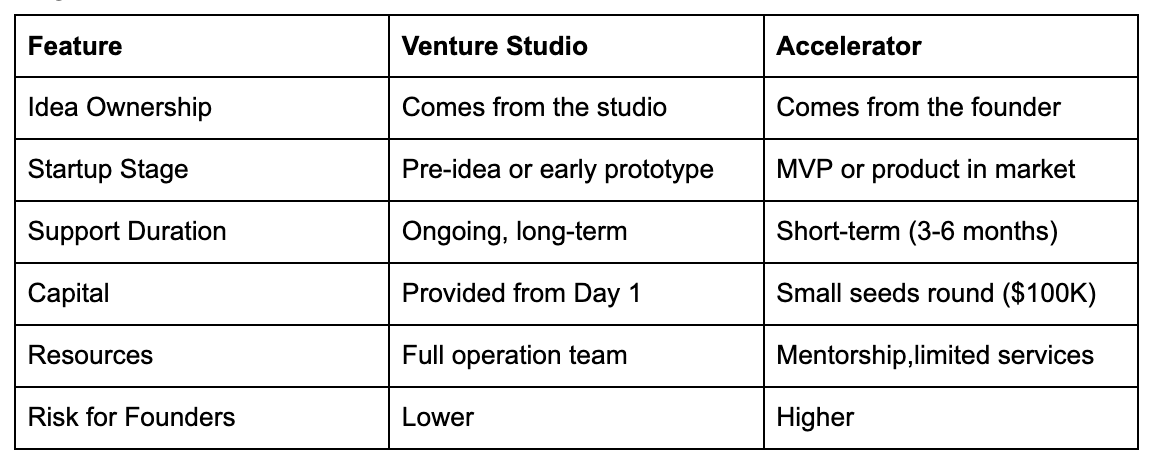

Amid this transformation, venture studios have emerged as a driving force. Unlike traditional venture capital firms that invest in existing startups, venture studios create startups from the ground up, developing ideas internally, testing them rigorously, and building teams around those that prove most promising.

But the real magic lies in how these studios identify and validate ideas with genuine potential. In a region as diverse and fast-changing as MENA, spotting the right opportunity requires a blend of creativity, data, and deep market understanding.

From Concept to Company: The Venture Studio Framework

The success of a venture studio depends on its ability to transform insights into investable businesses. This process follows a disciplined framework that moves from broad market exploration to focused validation and execution.

The four core stages are:

Opportunity Scanning

Idea Generation and Selection

Market Validation

Prototyping and Testing

Each stage ensures that only ideas with proven demand and scalable potential move forward.

1. Opportunity Scanning: Discovering the Gaps That Matter

MENA’s economies are evolving rapidly, moving beyond oil dependency and embracing digital transformation. This shift is creating new gaps in critical sectors such as fintech, logistics, healthtech, agritech, and renewable energy.

Top venture studios begin by identifying these gaps. They analyze macroeconomic trends, policy shifts like Saudi Vision 2030 or the UAE’s Centennial 2071, and consumer behavior to uncover unmet needs.

For example:

In markets with limited banking access, studios explore fintech solutions for mobile payments and microcredit.

In countries facing food security challenges, they investigate agritech models that improve production and distribution.

This stage is not about chasing trends; it’s about understanding where innovation meets necessity.

2. Idea Generation: Turning Insights into Business Concepts

Once opportunity areas are defined, venture studios organize structured ideation sessions that bring together cross-functional teams, strategists, engineers, designers, and entrepreneurs.

Their goal is to translate real-world problems into business opportunities. To filter viable ideas, they ask:

Is this a significant and scalable problem?

Does it align with market realities and regulations?

Can it expand across different MENA markets?

What value proposition makes it stand out?

The outcome is a shortlist of potential ventures, each supported by data and a clear hypothesis of how the business will create impact and profit.

3. Market Validation: Testing Assumptions Before Building

Validation is the most crucial step, and it is where most traditional startups stumble. MENA venture studios take a scientific approach to ensure their ideas are backed by evidence, not optimism.

They test each concept through a mix of:

Customer interviews and surveys to gauge real demand.

Landing pages or social media campaigns to track interest and engagement.

Minimum Viable Products (MVPs) or prototypes to test usability and pricing.

Pilot partnerships with corporates, governments, or NGOs to prove feasibility.

This stage is fast-paced but data-driven. If the market signals are strong, the idea moves forward; if not, it is refined or discarded. The focus is on learning quickly and cheaply, turning insights into informed decisions.

4. Prototyping and Testing: Building with Precision

Once validation confirms a market fit, the studio’s operational team, including product designers, engineers, and growth specialists, begins building a prototype.

Unlike independent startups that often struggle to find resources, venture studios already have internal teams and shared infrastructure. This enables rapid product development with high technical and creative quality.

The process emphasizes agility: building, testing, learning, and iterating until the product is ready for full launch. This disciplined experimentation allows studios to scale ventures faster and with lower risk.

Local Insight Meets Global Discipline

The MENA region’s diversity, from the Gulf’s advanced economies to North Africa’s emerging markets, means that what succeeds in one country may not in another.

That’s why top venture studios combine global venture-building methods with local market intelligence. They rely on:

Data analytics to identify patterns in consumer demand.

Local partnerships to navigate regulation and distribution.

Regional experts to ensure cultural alignment and trust.

This blend of data and context allows MENA studios to design ventures that are not only innovative but also grounded in reality.

Leaders in Venture Validation Across MENA

Several studios have become regional role models for their disciplined approach to identifying and validating ideas:

Enhance Ventures (UAE): Specializes in digital platforms, focusing on robust market testing before scaling.

Astrolabs (Saudi Arabia): Integrates venture building with ecosystem development and corporate innovation.

Flat6Labs (Egypt and Bahrain): Leverages its founder network and accelerator experience to validate ideas rapidly.

Nuwa Capital (UAE): Combines investment and operational expertise to ensure each venture aligns with long-term market trends.

These studios demonstrate that success in venture building is not about luck; it’s about structure, process, and precision.

Final Thought

The Art and Science of Spotting Success

The venture studio model is redefining how startups are built in MENA. By combining creativity with rigorous validation, studios ensure that every business they launch is founded on a solid evidence-based foundation, not assumptions.

In a region eager to diversify its economy and empower youth-led innovation, venture studios are doing more than just creating companies; they are fostering confidence in the entrepreneurial process itself.

By spotting success early and validating ideas systematically, MENA’s top venture studios are proving that innovation is not a gamble, it’s a strategy.