Most investments offer capital but leave you to figure out the rest. Hybrid investment models change that by combining strategic capital with operational expertise to support your venture’s growth at every stage. This approach creates a clear path to scalable success, giving your business tools beyond funding. Let’s examine how these models provide an edge in building ventures that grow sustainably and effectively. For more insights, check out this article.

Understanding Hybrid Investment Models

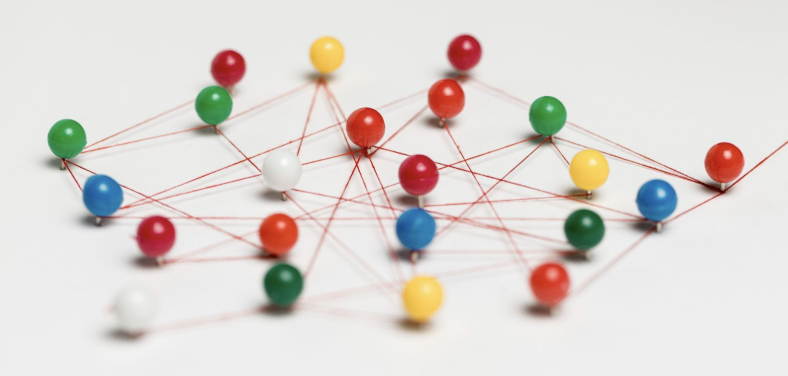

Hybrid investment models are reshaping how ventures grow. They blend financial support with strategic guidance, offering more than just capital. This approach provides a comprehensive support system for startups.

Defining Hybrid Investment Models

Hybrid investment models merge the best of venture capital with operational expertise. Imagine having both the funding you need and the strategic insights to use it wisely. These models are not just about money; they focus on nurturing ventures through every stage of growth.

Consider a startup that receives funding but also gains access to a team of experts. This team helps refine the business model, optimize operations, and even identify new market opportunities. This creates a robust platform for sustainable growth.

In contrast to traditional investment models, hybrids emphasize active partnership. This means continuous involvement, ensuring that ventures are not only well-funded but also strategically guided. With this dual support, startups can navigate challenges more effectively.

Benefits to Venture Growth

The benefits of hybrid models extend beyond funding. They provide startups with the tools needed to thrive in a competitive landscape. Startups can leverage strategic insights and operational support to accelerate their growth trajectory.

A key advantage is the ability to pivot swiftly. With expert guidance, startups can adapt to market changes without losing momentum. This agility is crucial in today’s fast-paced business environment.

Moreover, hybrid models foster innovation. By providing both capital and expertise, they encourage startups to explore new ideas and take calculated risks. This environment of innovation leads to breakthroughs that drive growth.

Strategic Capital and Operational Expertise

Strategic capital is more than just financial investment. It combines monetary support with strategic insights. This dual approach ensures that startups not only receive funding but also use it effectively. Operational expertise is crucial in this process, offering guidance on execution and growth strategies.

For instance, a startup might have an innovative product but struggle with market entry. With operational support, they gain insights on marketing strategies, customer engagement, and scaling operations. This comprehensive support is what sets hybrid models apart.

Hybrid models also emphasize long-term partnerships. This means ongoing support, adapting strategies as the venture evolves. This partnership approach ensures that startups are not left to navigate challenges alone.

Pathways to Scalable Success

Achieving scalable success requires more than just funding. It demands a strategic approach that bridges capital with growth. Hybrid investment models are designed to create a competitive edge, ensuring ventures scale effectively and sustainably.

Building a Competitive Edge

In a crowded market, a competitive edge is vital. Hybrid models offer this by providing both financial backing and strategic insights. This dual approach empowers startups to stand out from the competition. By aligning strategic goals with operational capabilities, ventures can achieve sustained growth.

Startups can leverage the expertise of their partners to identify unique market opportunities. This insight allows them to tailor their offerings to meet specific customer needs, creating a strong market presence.

Moreover, hybrid models encourage a culture of continuous improvement. By fostering innovation and learning, they ensure that startups remain relevant and competitive. This relentless pursuit of excellence is what drives scalable success.

Bridging Capital and Growth

Bridging the gap between capital and growth is crucial for any venture. Hybrid models achieve this by integrating strategic insights with financial support. This integration ensures that ventures are not only well-funded but also strategically positioned for growth.

Consider a startup with a groundbreaking product but limited market reach. With hybrid support, they receive funding to expand operations and strategic guidance on market entry strategies. This dual support accelerates their growth journey.

By aligning financial resources with growth objectives, hybrid models create a seamless pathway to success. This alignment ensures that ventures are not only profitable but also sustainable in the long run.

Real-World Success Stories

Real-world examples illustrate the power of hybrid models. Many startups have transformed their operations and achieved significant growth through this approach. These success stories highlight the effectiveness of combining capital with strategic support.

For instance, a tech startup struggling to scale its operations partnered with a hybrid investor. Through strategic guidance and financial backing, they expanded their market presence and achieved profitability within a year.

These success stories underscore the transformative impact of hybrid models. By providing both capital and strategic support, they enable ventures to overcome challenges and achieve their full potential.

Partnering for Venture Growth

For entrepreneurs, partnering with the right investors is crucial. Hybrid models offer a unique opportunity to collaborate with partners who provide both financial and strategic support. This partnership approach is key to driving venture growth and achieving long-term success.

Opportunities for Entrepreneurs

Entrepreneurs can benefit immensely from hybrid models. These models offer more than just funding; they provide access to a network of experts and resources. This access enables entrepreneurs to refine their strategies and accelerate growth.

For example, an entrepreneur with a promising idea might lack the resources to execute it. With hybrid support, they gain the financial backing and strategic insights needed to bring their vision to life.

Hybrid models also offer a sense of partnership. Entrepreneurs are not just receiving funding; they are collaborating with seasoned experts who are invested in their success. This collaborative approach fosters trust and empowers entrepreneurs to take bold steps.

The Role of Strategic Capital

Strategic capital plays a pivotal role in venture growth. It combines financial support with strategic insights, ensuring ventures are well-equipped to navigate challenges. This holistic approach to capital is what sets hybrid models apart.

For startups, strategic capital means more than just financial resources. It involves a partnership where investors actively contribute to the venture's success. This includes providing guidance on strategy, operations, and market expansion.

By integrating strategic capital into their growth plans, startups can achieve sustainable success. This approach ensures they are not only profitable but also resilient in the face of market changes.

Transforming Ventures with Mandalore Partners

Mandalore Partners exemplifies the power of hybrid models. As an active partner, they offer both strategic capital and operational expertise. This combination is key to transforming ventures and achieving scalable success.

Through their hands-on approach, Mandalore Partners supports startups at every stage of their journey. From strategy development to execution, they provide the insights and resources needed for growth.

By partnering with Mandalore Partners, entrepreneurs can access a wealth of expertise and resources. This partnership approach ensures that ventures are not only well-funded but also strategically positioned for success.