Introduction : La fin du statu quo bancaire

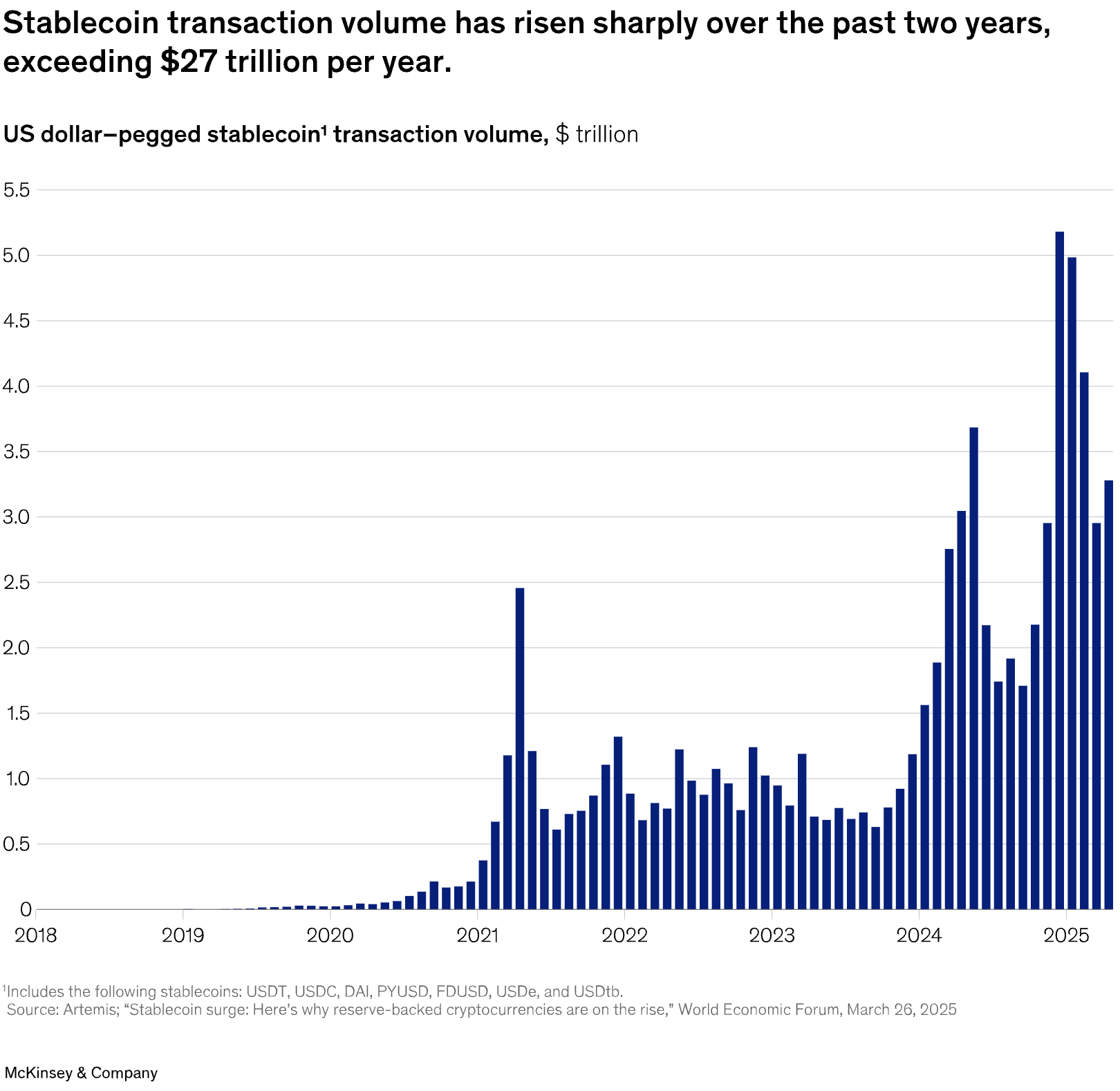

Le débat sur l'utilité des stablecoins est clos. Avec 250 milliards de dollars en circulation (une hausse de 100 % en 18 mois) et un volume transactionnel annuel dépassant les 27 000 milliards de dollars, la tokenisation des liquidités n'est plus une expérimentation marginale. C'est une menace existentielle pour l'infrastructure de paiements legacy qui n'a pas fondamentalement évolué depuis l'avènement de SWIFT.

Pourtant, ces volumes représentent encore moins de 1 % des flux monétaires globaux. Le potentiel de capture de valeur est donc immense. Nous sommes à l'aube d'un basculement structurel, catalysé par une clarification réglementaire sans précédent (MiCA en Europe, GENIUS Act aux USA) et une maturité technologique enfin atteinte.

Pour le Capital-Risque (VC) et les institutions financières, l'équation est simple : l'upside réside dans une infrastructure 24/7, un règlement instantané et une réduction drastique des coûts. Le risque, lui, se déplace de la volatilité technologique vers la conformité et la custody. Ce rapport analyse pourquoi 2025 est l'année pivot.

1. État du Marché des Stablecoins en 2025-2026

Le marché est dominé par un duopole de fait, mais la dynamique concurrentielle s'accélère. Sur les 250 milliards de dollars de capitalisation totale :

Tether (USDT) capture environ 155 milliards de dollars, dominant les marchés émergents et le trading.

Circle (USDC) sécurise 60 milliards de dollars, s'imposant comme le standard institutionnel et régulé.

En termes de flux, les stablecoins traitent quotidiennement entre 20 et 30 milliards de dollars de transactions réelles (hors trading haute fréquence). Si l'on compare cela aux 5 000 à 7 000 milliards traités quotidiennement par l'infrastructure legacy, la marge de progression est colossale. La croissance est exponentielle : les projections indiquent une capitalisation de 400 milliards de dollars fin 2025 et 2 000 milliards d'ici 2028.

2. Proposition de Valeur vs Infrastructures Legacy

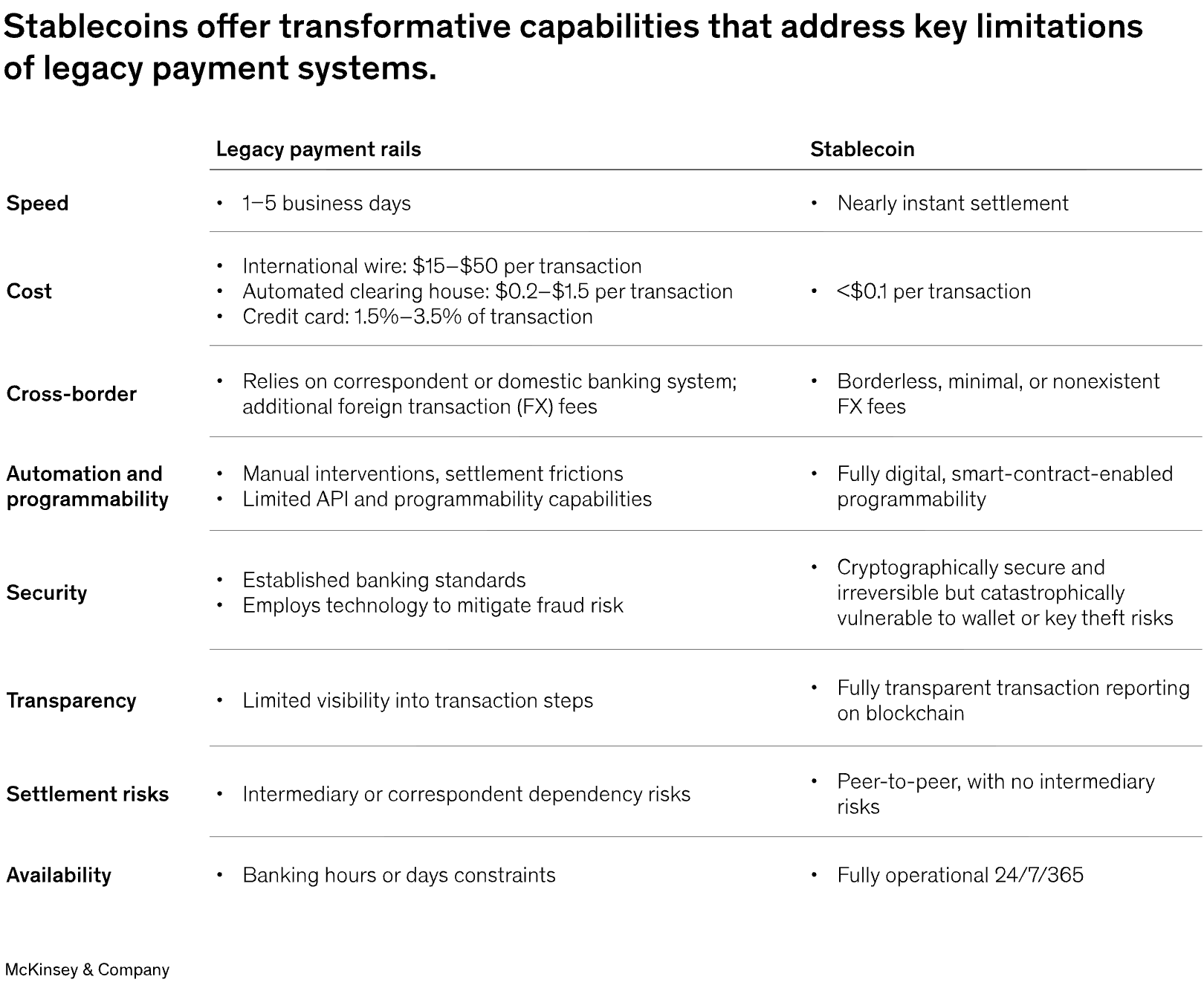

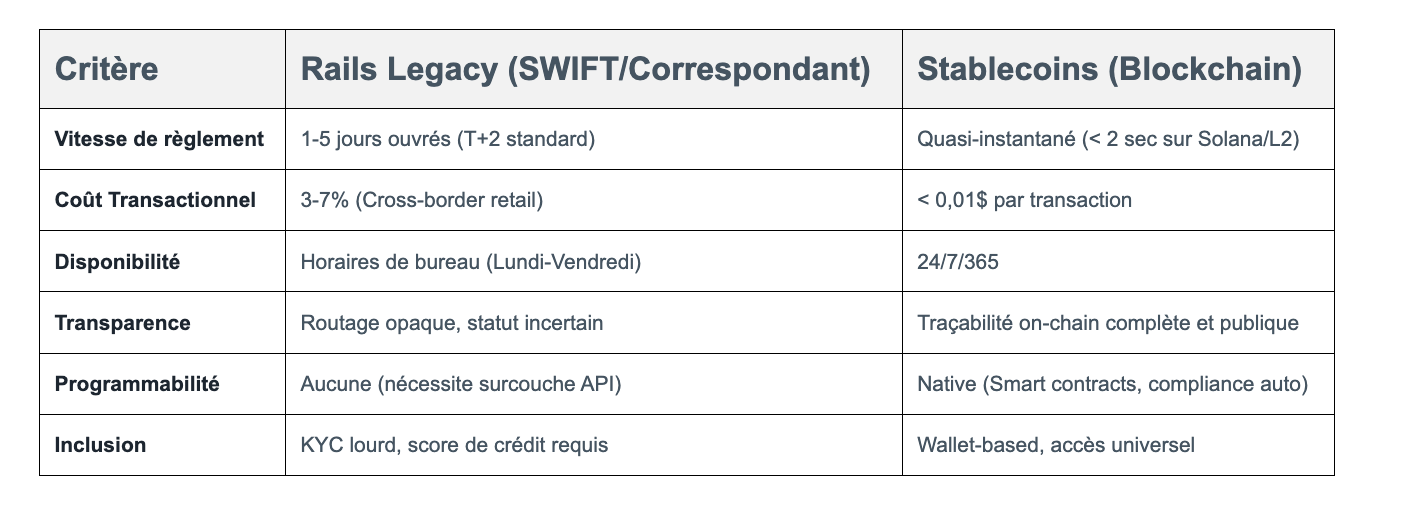

Les Pain Points Structurels des Rails Traditionnels

L'infrastructure bancaire actuelle (Correspondant Banking, SWIFT) souffre de frictions incompressibles liées à son architecture en batch-processing :

Délais : 1 à 5 jours ouvrés pour un règlement final cross-border.

Coûts : Empilement de frais intermédiaires et de change.

Disponibilité : Limitée aux horaires d'ouverture bancaires.

Exclusion : 1,7 milliard de personnes restent non-bancarisées en raison de coûts d'entrée prohibitifs.

L'Avantage Asymétrique des Stablecoins

La tokenisation ne se contente pas d'améliorer le système existant ; elle le remplace par une architecture supérieure.

3. Les 4 Catalyseurs de l'Inflexion 2025

1. Clarification Réglementaire Globale

Le risque réglementaire, jadis frein principal, devient un catalyseur. En Europe, le règlement MiCA (Markets in Crypto-Assets) impose désormais des audits stricts et des exigences de réserves, assainissant le marché. Aux USA, le GENIUS Act vise à établir une supervision fédérale pour garantir la parité dollar. En Asie (Singapour, Hong Kong, Japon), les licences pour émetteurs de stablecoins intègrent nativement les contrôles AML/KYC on-chain. Pour les VC, cela signifie une chose : le capital institutionnel a désormais le feu vert pour entrer.

2. Maturité Technologique (Infratech)

L'infrastructure a franchi le cap de la scalabilité. Les blockchains de nouvelle génération (Solana, Avalanche) et les Layer 2 sur Ethereum (Arbitrum, Base) offrent des frais négligeables. Parallèlement, la sécurité des wallets institutionnels (MPC, gestion de clés hardware) et les outils d'analytics (Chainalysis, TRM Labs) permettent une compliance en temps réel supérieure aux systèmes bancaires.

3. Adoption Institutionnelle Massive

Les incumbents ne combattent plus la technologie, ils l'adoptent :

JPMorgan traite plus d'1 milliard de dollars par jour via JPM Coin.

Le Canton Network fédère Goldman Sachs, UBS et Citibank autour d'actifs tokenisés.

Les banques centrales multiplient les projets concrets : Project Guardian (Singapour), mBridge (Chine-UAE) et Helvetia (Suisse).

4. L'Émergence des Yield-Bearing Tokens

C'est la disruption ultime du modèle de dépôt bancaire. Des fonds tokenisés comme BlackRock BUIDL ($2,9Md), Franklin BENJI ($0,8Md) ou Ondo USDY permettent d'utiliser des parts de fonds monétaires comme moyen de paiement liquide. L'argent dormant rapporte désormais du rendement en temps réel, sans verrouillage.

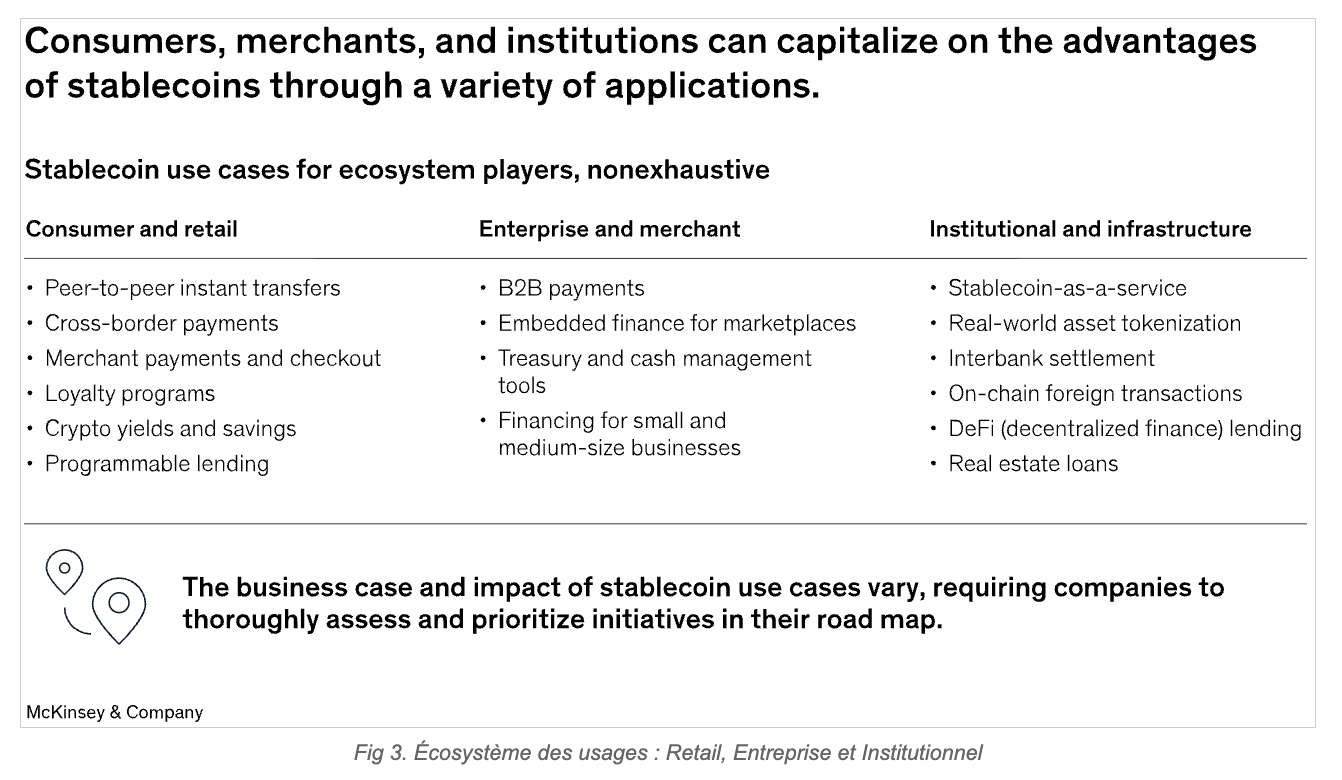

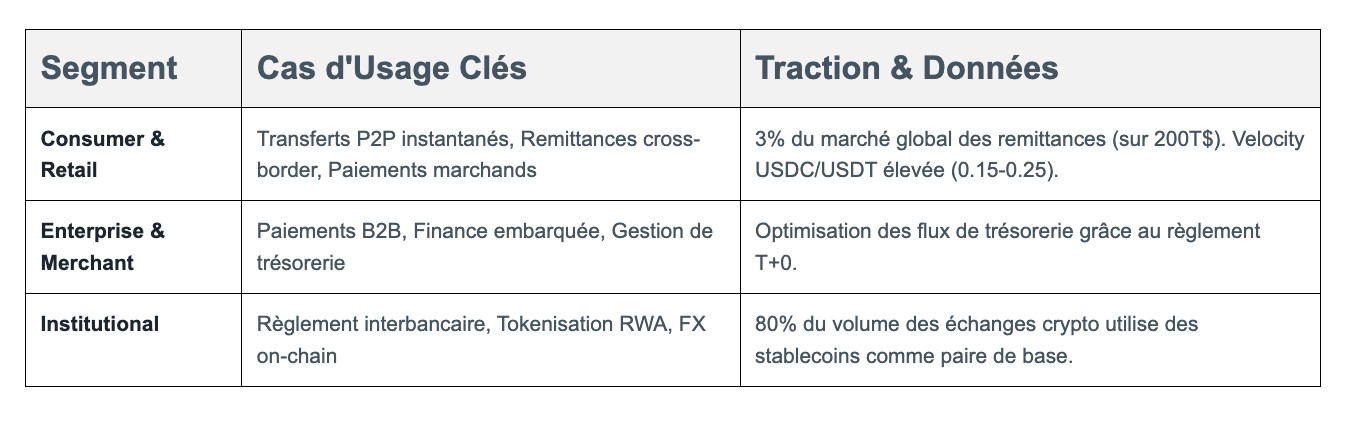

4. Cartographie des Cas d'Usage et Traction

L'utilisation des stablecoins se diversifie bien au-delà du trading crypto.

5. Matrice de Risques

Analyse Critique des Risques

Si l'opportunité est massive, ignorer les risques structurels serait une erreur fatale pour tout investisseur.

Risques Opérationnels : Le risque de de-pegging persiste si la transparence des réserves n'est pas totale. La custody reste le point de défaillance unique (SPOF) critique.

Risques Juridiques : En cas de faillite de l'émetteur, les détenteurs sont souvent des créanciers non sécurisés. Le statut juridique du "droit de rachat" reste à tester devant les tribunaux.

Risques Systémiques : Une concentration excessive (Tether + Circle = 85% du marché) crée un risque de contagion. De plus, la fuite des dépôts vers les stablecoins menace le modèle de financement traditionnel des banques commerciales.

6. Implications Stratégiques pour Investisseurs et Institutions

Positionnement VC : Où Déployer le Capital ?

L'argent intelligent ne chasse pas seulement les émetteurs, mais l'infrastructure qui les rend utilisables :

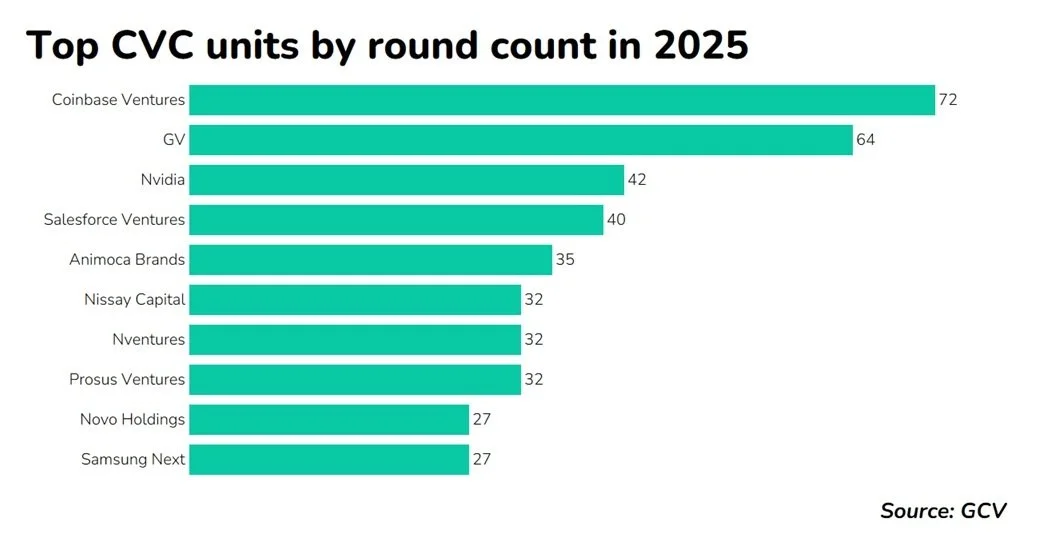

Infrastructure (Pelles et Pioches) : Custody institutionnelle, portefeuilles MPC, analytics on-chain et compliance. C'est ici que se construisent les douves (moats) technologiques.

Payment Rails : Fintechs intégrant nativement les stablecoins pour le B2B (ex: SAP, PayPal).

Yield-Bearing Instruments : Les fonds monétaires tokenisés représentent le futur de la gestion de trésorerie corporate.

Corridors Cross-Border : Focus géographique sur les corridors Europe ↔ Asie du Sud-Est (Singapour, Vietnam, Indonésie) où la friction bancaire est maximale.

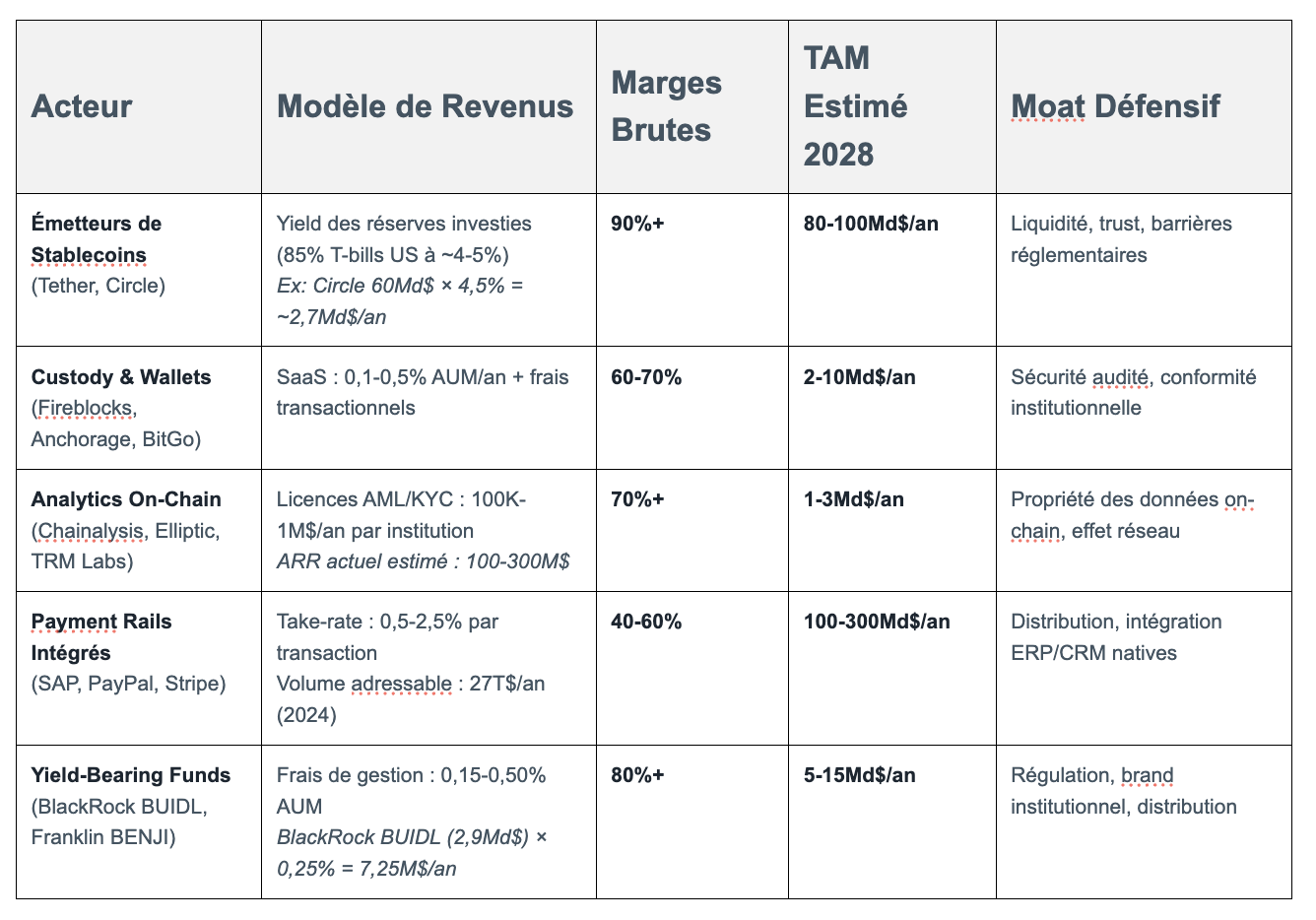

Unit Economics et Capture de Valeur par Acteur

La question fondamentale pour tout investisseur : où se capte réellement la valeur dans l'écosystème stablecoin ? Contrairement aux idées reçues, ce ne sont pas uniquement les émetteurs qui génèrent des revenus massifs. L'infrastructure autour des stablecoins offre des marges SaaS élevées avec moins de risque systémique.

📊 Perspective Critique VC

Upside maximum : Les émetteurs (Circle, Tether) capturent l'essentiel de la valeur via le float des réserves. Mais ce sont des business winner-takes-most avec un risque réglementaire et de concentration élevé.

Meilleur risque/rendement : L'infrastructure (custody, analytics, payment rails) offre des marges SaaS élevées (60-70%) avec moins de risque systémique. C'est ici que se joue le dealflow intelligent pour un fonds early-stage.

Piège à éviter : Ne pas investir dans des stablecoins "me-too" sans liquidité ni différenciation réglementaire. Le marché est un winner-takes-most, et sans 10Md$ de circulation minimum, l'utilité est nulle.

Roadmap pour les Banques

Le temps de l'observation est révolu. Les banques doivent choisir leur modèle de participation :

Tier 1 : Lancer un stablecoin propriétaire (difficile à scaler hors réseau interne).

Tier 2 : Rejoindre un consortium pour mutualiser la liquidité.

Regional Banks : S'appuyer sur des fournisseurs technologiques (Fiserv, FIS) ou partenariats avec émetteurs globaux (Circle) pour ne pas être désintermédiées.

7. Les 6 Signaux d'un Marché Mature

Pour monitorer l'accélération, surveillez ces indicateurs clés :

Attentes consommateurs : Le paiement instantané global devient la norme exigée.

Clarté réglementaire : Passage effectif du GENIUS Act (US) et harmonisation totale MiCA.

M&A et IPOs : L'IPO de Circle, acquisitions majeures (ex: Stripe rachetant Bridge).

Réponse des Incumbents : Lancement de stablecoins conjoints par des consortiums bancaires US/EU.

Infrastructure critique : On/off ramps fluides et intégration native dans les applications bancaires mobiles.

Volumes transactionnels : Doublement de la circulation (vers 500Md$) porté par des usages non-crypto.

Conclusion : Perspective VC - "This is the Way"

Nous avons atteint le point d'inflexion. La convergence de la réglementation, de la technologie et de l'adoption institutionnelle confirme que la tokenisation n'est pas une mode, mais la prochaine itération du système financier.

Pour l'investisseur européen ou asiatique, trois thèses tactiques se dégagent :

#1 Position Principale : Infrastructure Cross-Border Europe-SEA

Ciblez les startups facilitant les flux B2B entre l'Europe et l'Asie du Sud-Est. La demande corporate est forte, les synergies avec des hubs comme Singapour sont évidentes.

#2 Alternative Solide : Yield-Bearing Tokenized Funds

Investir dans la disruption du cash management. La traction de BlackRock prouve le product-market fit. L'enjeu est l'inclusion financière corporate.

#3 Option Conditionnelle : Champion Européen Régulé MiCA

L'Europe a besoin d'une alternative crédible au dollar tokenisé. Un émetteur d'Euro-stablecoin parfaitement régulé (MiCA) représente une opportunité de souveraineté numérique majeure.