Les Venture Studios représentent une approche innovante de l’entrepreneuriat. Plutôt que de soutenir une seule startup à la fois, ils créent, incubent et accélèrent plusieurs projets simultanément, en combinant capital, expertise et ressources partagées. Face aux défis du financement classique et aux exigences croissantes en matière de rendement et de durabilité, ces structures explorent de plus en plus le financement adossé à des actifs (Asset-Backed Financing ou ABF).

En 2025, cette approche devient un levier stratégique pour transformer les idées en entreprises viables et durables. L’objectif : sécuriser les investissements tout en donnant aux startups une marge de manœuvre pour innover et croître.

Voici les 6 grandes raisons pour lesquelles les Venture Studios adoptent cette stratégie.

1. Sécuriser le capital dans un environnement incertain

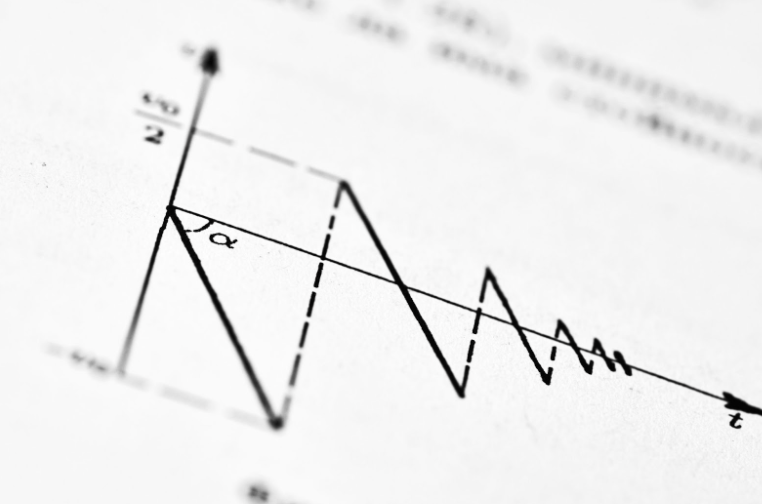

Le financement adossé à des actifs permet aux Venture Studios de réduire le risque lié aux investissements dans des projets encore jeunes. En adossant un financement à des actifs tangibles ou financiers — brevets, équipements, stocks, créances ou flux de revenus futurs — les studios protègent leur capital tout en offrant aux startups un financement flexible.

Par exemple :

Un Venture Studio spécialisé en mobilité durable peut utiliser les véhicules prototypes comme collatéral pour obtenir un financement bancaire.

Des studios travaillant dans la deeptech mobilisent leurs équipements de recherche et brevets pour sécuriser des fonds nécessaires à des phases de R&D coûteuses.

Cette approche permet de réduire l’exposition au risque, particulièrement dans des secteurs innovants où l’incertitude est élevée et la valorisation des startups difficile à estimer.

2. Favoriser le développement rapide des startups incubées

L’un des principaux avantages du financement adossé à des actifs est qu’il fournit des liquidités immédiates pour soutenir le développement opérationnel. Contrairement au capital-risque, qui peut être dilutif et soumis à des cycles de levées complexes, l’ABF permet aux startups d’accéder rapidement à des fonds, en utilisant leurs actifs existants.

Exemples :

Un studio incubant des startups SaaS peut adosser un prêt aux revenus récurrents (MRR) générés par la plateforme pour financer de nouvelles fonctionnalités ou le marketing.

Des studios en santé numérique utilisent les équipements médicaux comme garantie pour obtenir des financements rapides destinés à la validation clinique ou aux tests pilotes.

Grâce à ce mécanisme, les Venture Studios peuvent accélérer la mise sur le marché, améliorer la productivité et renforcer les chances de succès des startups qu’ils incubent.

3. Optimiser le rendement tout en minimisant la dilution

Le capital-risque classique implique souvent que les fondateurs cèdent une part significative de leur entreprise pour obtenir des financements. L’ABF offre une alternative moins dilutive, permettant aux fondateurs de conserver le contrôle stratégique tout en obtenant des ressources financières substantielles.

Par exemple :

Dans le secteur cleantech, un Venture Studio peut mobiliser des panneaux solaires installés comme collatéral pour financer l’extension d’un projet énergétique sans diluer la participation des fondateurs.

Les studios spécialisés en fintech peuvent utiliser des contrats clients à venir ou des flux de transactions pour lever des fonds sans céder d’actions.

Cette approche équilibre rendement et contrôle, ce qui est particulièrement attractif pour des équipes fondatrices ambitieuses souhaitant rester décisionnaires tout en accélérant leur croissance.

4. Accéder à de nouveaux types d’investisseurs

Le financement adossé à des actifs attire un profil d’investisseurs différent, souvent plus institutionnel et prudent. Assureurs, fonds de pension, family offices et investisseurs spécialisés dans l’économie réelle voient dans l’ABF une solution sécurisée et transparente.

Exemples :

Certains Venture Studios européens collaborent avec des fonds d’infrastructure pour financer des startups développant des technologies vertes, en utilisant les équipements ou infrastructures comme collatéral.

Des studios travaillant dans la logistique ou la mobilité exploitent des flottes de véhicules ou des stocks comme garantie pour attirer des investisseurs institutionnels.

Cette diversification des sources de financement permet aux studios d’étendre leur capacité d’investissement, tout en réduisant la dépendance au capital-risque traditionnel, souvent plus volatil.

5. Faciliter la structuration des projets complexes

De nombreuses startups incubées par des Venture Studios sont engagées dans des projets technologiquement complexes ou nécessitant des investissements significatifs. L’ABF offre un cadre structuré et transparent, qui permet de sécuriser des financements tout en alignant les intérêts des parties prenantes.

Par exemple :

Dans la santé numérique, des startups utilisant des équipements médicaux sophistiqués peuvent structurer leurs prêts en fonction des flux de revenus attendus des hôpitaux ou cliniques partenaires.

Des projets de mobilité ou d’énergie renouvelable peuvent être financés en adossant les prêts à des infrastructures physiques ou des contrats de long terme, assurant ainsi un suivi clair et sécurisé.

Cette structuration permet de réduire les frictions juridiques et financières, ce qui est essentiel pour des startups en phase d’incubation.

6. Encourager l’innovation durable et responsable

Enfin, le financement adossé à des actifs permet aux Venture Studios de promouvoir une innovation responsable, en orientant le capital vers des projets durables et à impact réel. Contrairement à certains financements purement spéculatifs, l’ABF favorise des initiatives ayant un potentiel tangible pour l’économie et la société.

Exemples :

Les studios incubant des technologies propres peuvent mobiliser des équipements ou infrastructures comme collatéral, encourageant ainsi des projets à faible empreinte carbone.

Les studios spécialisés en agritech peuvent utiliser des serres, équipements agricoles ou stocks comme garantie, soutenant des projets contribuant à la sécurité alimentaire et à l’inclusion économique.

L’ABF devient ainsi un outil stratégique pour aligner finance, innovation et impact sociétal, tout en garantissant la sécurité du capital investi.

Conclusion : un levier stratégique pour les Venture Studios en 2025

En 2025, le financement adossé à des actifs se positionne comme un instrument clé pour les Venture Studios. Il permet de sécuriser le capital, accélérer le développement des startups, limiter la dilution des fondateurs et attirer de nouveaux types d’investisseurs.

En offrant une alternative flexible et sécurisée au financement traditionnel, l’ABF devient un pont entre l’innovation et la finance réelle, favorisant des projets ambitieux et durables. Les Venture Studios qui adoptent cette approche peuvent ainsi créer un écosystème entrepreneurial plus robuste, capable de transformer des idées prometteuses en entreprises prospères et responsables.