Introduction

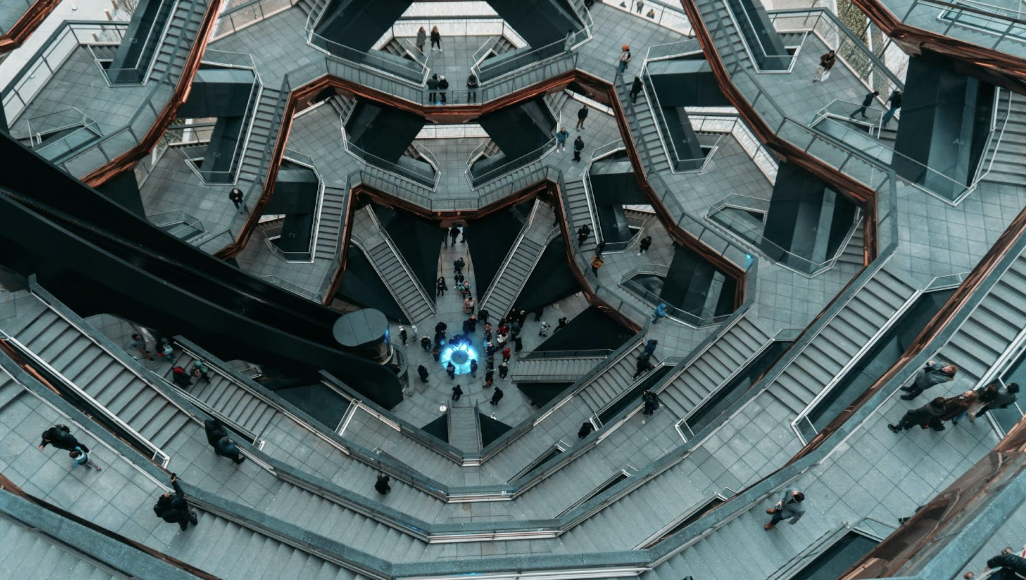

In the digital economy, competitive advantage is increasingly defined by intangible assets rather than physical ones. Data, brand, intellectual property, organizational knowledge, and networks now drive the majority of value creation in high-growth companies. Venture studios—also known as start-up studios or company builders—are uniquely positioned to identify, develop, and scale these intangible assets across their portfolios.

Unlike traditional investors, venture studios are deeply involved in venture creation from inception. This proximity allows them not only to fund start-ups, but to actively shape and leverage intangible assets in a systematic and repeatable way. As a result, venture studios often generate stronger foundations for long-term value creation and improved risk-adjusted returns.

Intangible Assets as the Core of Venture Studio Value Creation

From day one, venture studios view intangible assets as strategic building blocks rather than by-products of growth. While traditional start-ups may develop data capabilities, brand identity, or intellectual property organically over time, venture studios intentionally design these assets into the venture creation process.

This structured approach enables studios to accelerate learning, reduce duplication, and transfer value across multiple start-ups—turning intangible assets into scalable, portfolio-level advantages.

Leveraging Data Across the Studio Portfolio

Data is one of the most powerful intangible assets venture studios manage. Studios often centralize data infrastructure, analytics tools, and governance frameworks that support multiple start-ups simultaneously. This allows early ventures to benefit from enterprise-level data capabilities without bearing the full cost.

By aggregating insights across ventures, such as customer behavior, pricing experiments, and go-to-market performance, studios create feedback loops that inform future venture design. Over time, this shared intelligence improves idea selection, product-market fit, and capital efficiency.

Moreover, studios embed responsible data practices early, ensuring compliance, security, and ethical use. This proactive governance increases the long-term value of data assets and strengthens investor confidence.

Building Brands with Institutional Discipline

Brand is another intangible asset that venture studios manage with deliberate intent. Rather than treating branding as a late-stage marketing exercise, studios establish brand positioning, messaging, and identity frameworks at the earliest stages of venture development.

Many venture studios maintain in-house brand and design teams that work across the portfolio. This ensures professional standards, consistency, and speed while allowing each start-up to develop a distinct market identity. Strong early branding reduces customer acquisition costs, builds trust, and supports premium positioning.

From an investor perspective, studio-backed start-ups often present stronger brand coherence and credibility, even at early stages—an important signal in crowded digital markets.

Structuring and Protecting Intellectual Property

Intellectual property is central to the venture studio model, particularly in technology, data-driven, and platform-based businesses. Studios typically manage IP strategy centrally, ensuring that patents, trademarks, copyrights, and trade secrets are identified, protected, and documented from inception.

This centralized IP management reduces legal risk, avoids ownership disputes, and ensures clean capitalization structures. It also enhances the attractiveness of studio-backed start-ups to later-stage investors and acquirers, for whom IP clarity is a critical due diligence factor.

By institutionalizing IP creation and protection, venture studios transform innovation into a defensible and monetizable asset.

Transferring Organizational Knowledge and Processes

Beyond formal assets, venture studios generate significant value through the accumulation and transfer of organizational knowledge. Lessons learned from previous ventures, successful or not, are codified into playbooks, templates, and operating procedures.

These knowledge assets reduce learning curves for new start-ups, enabling faster execution and fewer costly mistakes. This institutional memory is difficult for standalone start-ups to replicate and becomes a durable competitive advantage for the studio over time.

For investors, this repeatability is a key differentiator between venture studios and traditional early-stage investment vehicles.

Networks and Relationships as Strategic Assets

Networks represent another powerful intangible asset leveraged by venture studios. Studios cultivate relationships with investors, corporate partners, regulators, talent pools, and ecosystem stakeholders. These networks are shared across the portfolio, giving start-ups accelerated access to capital, customers, and strategic partnerships.

By embedding ventures within an established network, studios reduce time-to-market and increase credibility, particularly in regulated or enterprise-focused sectors. Network leverage also improves fundraising efficiency, as studio-backed ventures often benefit from pre-existing investor trust.

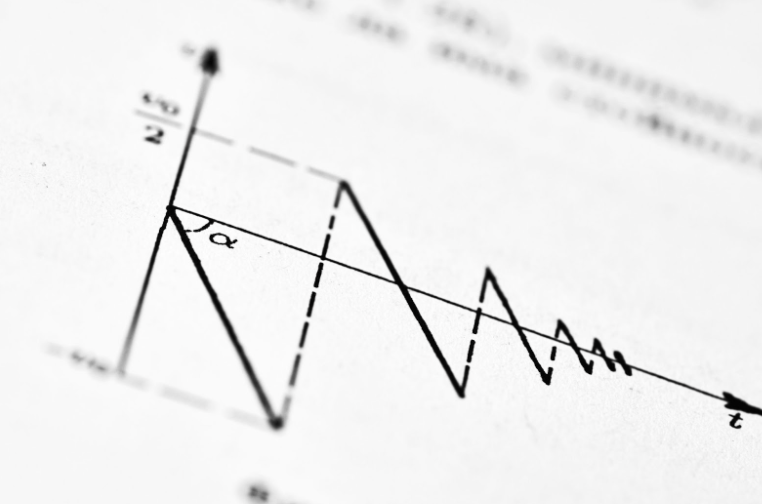

Portfolio-Level Synergies and Compounding Advantage

One of the most distinctive features of venture studios is their ability to create portfolio-level synergies from intangible assets. Data insights from one venture inform another. Brand-building capabilities improve across the portfolio. IP strategies evolve and strengthen with each new company.

This compounding effect allows venture studios to improve outcomes over time, even as individual ventures succeed or fail. Intangible assets, once built, continue to generate value far beyond a single start-up.

Risk Management Through Intangible Asset Control

Control over intangible assets also enhances risk management. Studios can intervene early when data signals weak traction, reposition brands in response to market feedback, or protect IP before vulnerabilities emerge. This proactive involvement reduces downside risk and capital loss.

Institutional investors increasingly value this level of control, particularly in early-stage environments characterized by uncertainty and rapid change.

Final Thought

Venture studios are not merely builders of companies, they are architects of intangible value. By systematically developing and leveraging data, brand, intellectual property, knowledge, and networks, venture studios create start-ups with stronger foundations and clearer paths to scale.

In a digital economy where intangible assets define success, venture studios offer a uniquely effective model for transforming ideas into resilient, high-value enterprises. For investors, founders, and ecosystem partners, the strategic management of intangible assets is one of the most compelling advantages of the venture studio model.