Introduction

Le corporate venture capital (CVC) a longtemps été perçu comme un levier structuré et relativement homogène d’innovation pour les grandes entreprises. Mais l’année 2025 pourrait marquer une rupture nette. En l’espace de douze mois, les montants investis, les profils des investisseurs et les dynamiques de marché ont profondément changé.

On n’assiste plus à une simple montée en puissance du corporate venture, mais à une fracture claire entre deux marchés distincts, avec, d’un côté, quelques géants capables de redéfinir les règles du jeu, et de l’autre, une majorité d’acteurs contraints de revoir leurs ambitions.

Une explosion des méga-deals sans précédent

Les chiffres parlent d’eux-mêmes. En 2024, on recensait 12 tours de financement de startups dépassant le milliard de dollars avec une participation corporate. En 2025, ce chiffre est passé à 19. Plus marquant encore, la valeur cumulée des 20 plus gros tours impliquant des corporates est passée de 34 milliards à plus de 58 milliards de dollars, soit une hausse d’environ 70 % en un an.

Ce type de progression ne relève pas d’une croissance organique. Il s’agit d’un changement brutal d’échelle, qui transforme en profondeur la physionomie du marché.

Meta et Nvidia : les nouveaux faiseurs de marché

Deux acteurs expliquent à eux seuls une grande partie de cette bascule : Meta et Nvidia.

Meta, historiquement prudente vis-à-vis du venture capital, a opéré un virage spectaculaire en participant aux deux plus importants tours de financement de l’année :

Scale AI, avec une levée de 14,3 milliards de dollars

Databricks, avec un tour de série J à 10 milliards de dollars

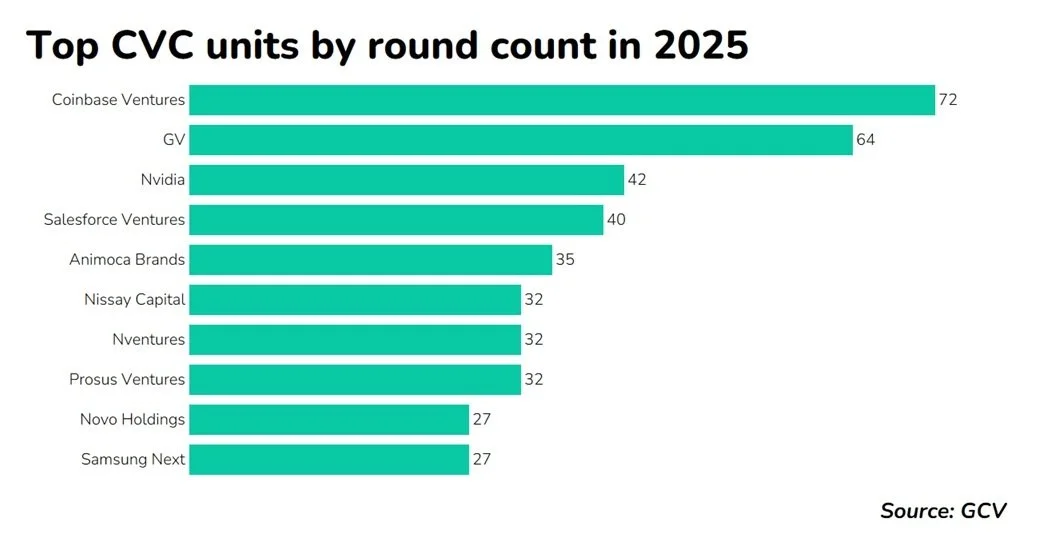

De son côté, Nvidia s’est comportée moins comme un fabricant de semi-conducteurs que comme un véritable fonds souverain technologique. En 2025, le groupe a soutenu près de 80 startups et figure dans 7 des 20 plus grosses opérations de l’année.

Ces investissements massifs, concentrés sur l’IA, l’énergie ou encore le quantique, ont redéfini les standards de valorisation… mais uniquement pour ceux capables de suivre.

Un marché du corporate venture désormais à deux vitesses

C’est ici que la fracture devient évidente.

Au sommet du marché, une poignée de géants de la Silicon Valley déploient des montants colossaux, imposant des valorisations à neuf ou dix chiffres que peu d’acteurs peuvent absorber sans mettre en péril leur discipline financière.

En dessous, on retrouve l’immense majorité des corporates, qui adoptent une approche radicalement différente :

retour à des investissements plus early-stage,

recentrage sur des écosystèmes locaux,

ciblage de technologies strictement adjacentes à leur cœur de métier.

Ce positionnement n’est pas uniquement dicté par la prudence. Il relève aussi d’une forme de stratégie défensive. Quand les prix d’entrée deviennent inaccessibles, la retenue cesse d’être un signe de frilosité et devient un choix rationnel.

Repenser l’innovation au-delà du venture capital

Face à cette nouvelle réalité, de nombreuses entreprises réévaluent leur approche de l’innovation. Le corporate venture capital n’est plus l’unique voie.

Certaines organisations reviennent à la création de startups en interne, malgré les défis opérationnels que cela implique. D’autres testent des modèles de venture client, permettant d’apprendre et d’expérimenter sans prise de participation au capital.

On observe également une tendance croissante à externaliser la prise de décision, en devenant limited partner dans des fonds spécialisés plutôt que d’investir en direct.

En 2025, investir directement au cœur du cycle d’hype technologique s’est révélé être un exercice réservé aux acteurs les plus solides financièrement et stratégiquement.

2026 : poursuite de l’euphorie ou correction du marché ?

La trajectoire pour 2026 reste incertaine. Plusieurs lignes de fracture sont déjà visibles :

une concurrence accrue des fabricants de puces chinois,

l’émergence d’approches radicalement nouvelles en intelligence artificielle, portées par des figures majeures de la recherche,

et surtout, la fragilité d’un boom des data centers largement financé par la dette, avec des actifs susceptibles de se déprécier plus vite que les revenus ne s’accumulent.

Ces tensions pourraient alimenter une correction. Mais elles pourraient aussi renforcer encore davantage la domination des acteurs capables d’absorber le risque.

Conclusion : un nouveau cycle pour le corporate venture capital

Une chose semble acquise : le corporate venture capital est entré dans une phase où les lois de la gravité ne s’appliquent plus de la même manière à tous. Pour une minorité d’acteurs, les contraintes semblent presque optionnelles. Pour tous les autres, le parcours restera volatil, exigeant et hautement stratégique.

Dans ce contexte, le succès ne dépendra plus seulement de la capacité à investir, mais surtout de la capacité à choisir le bon modèle d’innovation, au bon moment, avec le bon niveau d’exposition au risque.