At Mandalore Partners, we believe the future of company building is fundamentally different from what we've seen before. As we navigate through 2025, we're witnessing a paradigm shift that goes beyond traditional venture capital models, and we're positioning ourselves at the forefront of this transformation.

The old playbook of throwing capital at promising startups and hoping for exponential returns is not just outdated; it's counterproductive in today's complex business environment. We've observed that the most successful companies of the past five years weren't just well-funded, they were strategically guided, operationally supported, and deeply integrated into their target industries from day one.

Our Vision: Beyond Capital to Strategic Partnership

We've spent years observing the venture capital landscape, and frankly, we believe the traditional model is broken. The industry generated $149.2 billion in exit value in 2024, yet despite a $47 billion increase in overall deal value, we saw 936 fewer deals compared to the previous year. This tells us something profound: the market is demanding quality over quantity, strategic depth over transactional relationships.

At Mandalore, we see this as validation of our core thesis. The future belongs to companies that receive more than just capital, they need strategic expertise, operational support, and deep industry integration. This is why we've pioneered our Venture Capital-as-a-Service (VCaaS) model.

What We Mean by Venture Capital-as-a-Service

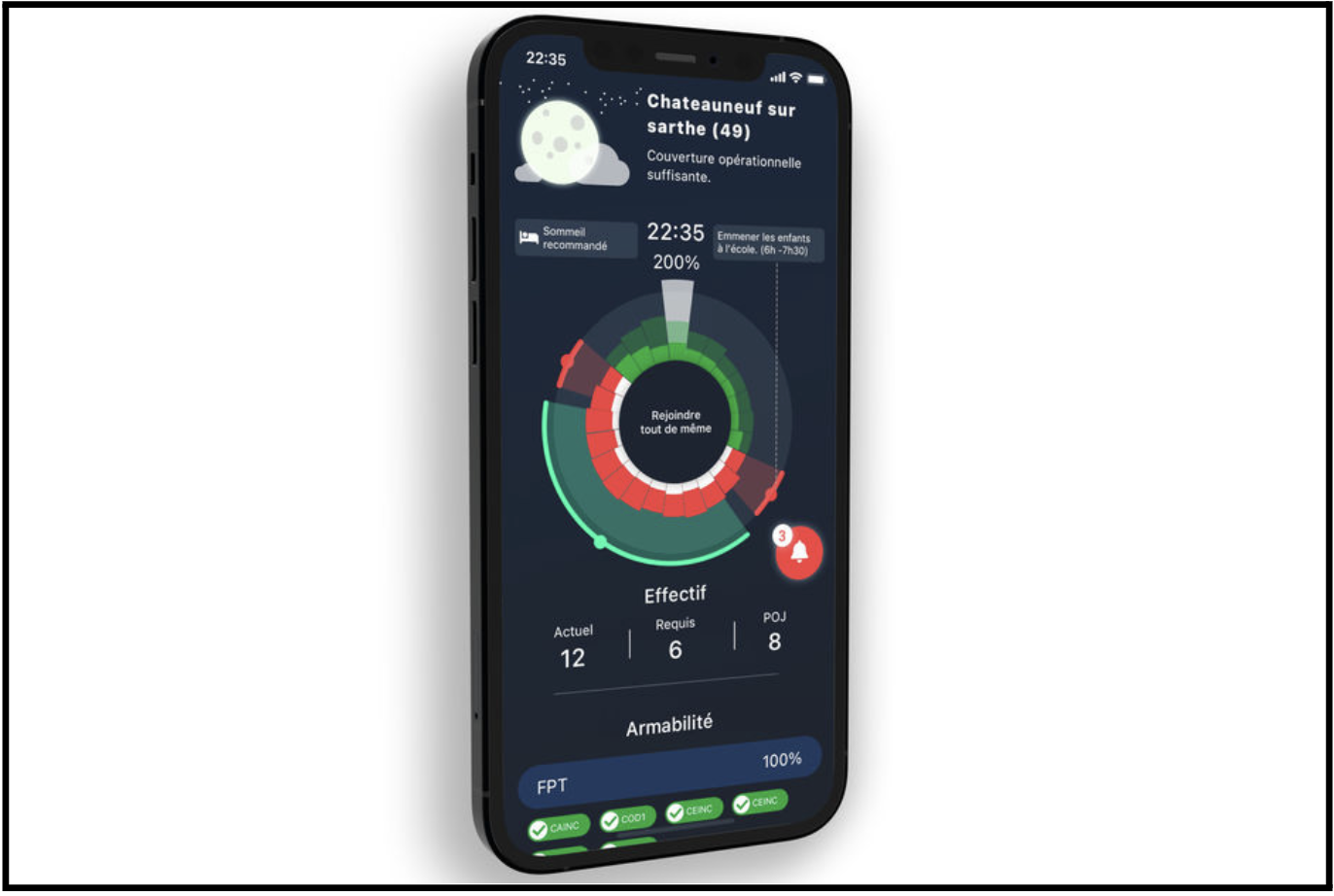

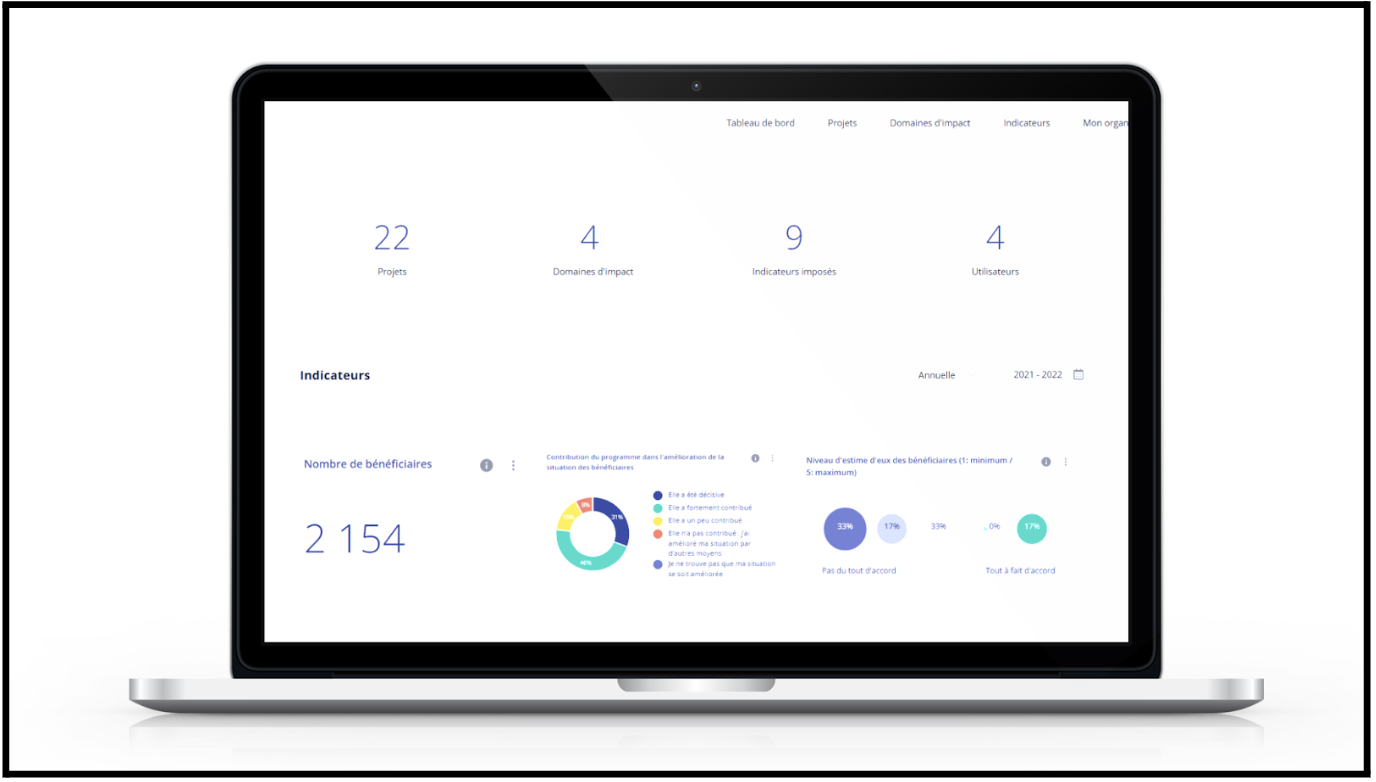

At Mandalore Partners, we don’t just write checks and step back, we embed ourselves as strategic partners through our VCaaS model, transforming how corporations build and scale innovation. Unlike traditional VCs, we stay hands-on from idea to market leadership, providing not only capital but deep regulatory expertise, industry networks, and operational insight. Our work with insurtech startups shows how this integrated approach turns potential into market dominance, proving that success hinges on more than just technology—it demands the right strategic guidance. With 93% of CEOs set to maintain or grow corporate venture investments in 2024, our model is exactly what forward-thinking companies need: a trusted partner to co-architect their future.

Our 6 Ss Framework: The Architecture of Success

We've developed what we call the 6 Ss model, our proprietary framework that has become the gold standard for successful company building in the modern era. This isn't theoretical; it's battle-tested across dozens of portfolio companies and multiple market cycles:

1.Strategy: We believe every successful company begins with a clear strategic vision aligned with market realities. Our data-driven approach ensures the startups we partner with address genuine market needs rather than pursuing solutions seeking problems.

2. Sourcing: We've built a global network and AI-powered sourcing capabilities that enable us to discover breakthrough technologies and visionary entrepreneurs before they become obvious opportunities. We're not followers, we are discoverers.

3. Scaling: Growth without foundation leads to failure. We provide operational expertise that helps companies build sustainable scaling mechanisms, from technology infrastructure to team development and market expansion strategies.

4. Synergy: We facilitate strategic partnerships that amplify growth potential and create competitive advantages. The most successful companies of the future will be those that create meaningful connections within their ecosystems.

5. Sustainability: Our investment thesis prioritizes companies building solutions for tomorrow's challenges. We consider long-term viability across financial, environmental, and social dimensions.

6. Success: We measure success not just in financial returns, but in creating lasting value for all stakeholders, entrepreneurs, corporations, and society at large.

How We're Leveraging Technology Convergence

We're particularly excited about the convergence of artificial intelligence, IoT, and robotics. These technologies aren't just changing how companies operate, they're fundamentally transforming how they're built.

Our portfolio companies are reimagining traditional industries through technological integration. We're backing robotics companies creating new paradigms for industrial automation and AI-powered startups revolutionizing risk assessment in insurance. What excites us most is witnessing the emergence of hybrid business models that combine digital innovation with deep industry expertise, creating defensible moats that traditional tech companies can't replicate.

This convergence represents more than technological advancement; it's the foundation of sustainable competitive advantage in the next decade.

Our Take on Market Corrections and Opportunities

The valuation corrections from 2021 highs have created what we see as unprecedented opportunities. While others view down rounds and unicorn devaluations as challenges, we see them as market efficiency improvements that favor strategic investors like us.

We're witnessing trends like co-investments, extensions, and significant valuation cuts, all of which play to our strengths as strategic partners who provide more than capital. When financial investors retreat, strategic value becomes even more important.

This market correction has also revealed something crucial: companies built on solid fundamentals with strong strategic partnerships weather economic storms better than those relying solely on financial backing. Our portfolio companies have demonstrated remarkable resilience during this period, with several achieving profitability ahead of schedule while their purely VC-backed competitors struggled with runway management.

What We Predict for the Next Decade

Based on our market position and portfolio insights, we see several key trends defining the next decade of company building:

Ecosystem Integration: We believe successful companies will be those that seamlessly integrate into broader innovation ecosystems, creating value through partnerships rather than competition. This aligns perfectly with our VCaaS model. Companies that try to build everything in-house will find themselves outmaneuvered by those that strategically leverage ecosystem partnerships.

Regulatory Proactivity: Companies that anticipate and shape regulatory frameworks rather than merely comply with them will gain significant competitive advantages. Our deep industry expertise positions us to help companies navigate this complexity. We've seen companies gain 18-month market advantages simply by understanding regulatory trends before their competitors.

Stakeholder Capitalism: We're investing in companies that create value for all stakeholders, customers, employees, investors, and society, rather than optimizing for single metrics. This isn't just about ESG compliance; it's about building sustainable business models that can weather long-term market cycles.

Global-Local Balance: Future companies will need to operate globally while maintaining deep local expertise and cultural sensitivity. Our network enables this balance, helping companies expand internationally while maintaining local market authenticity.

AI-Human Collaboration: The future belongs to companies that enhance human capabilities rather than replace them. We're particularly excited about companies that use AI to augment human decision-making rather than automate it away entirely.

Our Competitive Advantage

What sets us apart is our unique position at the intersection of corporate strategy and entrepreneurial execution. We combine the best of corporate strategic thinking with entrepreneurial agility, creating sustainable competitive advantages for all stakeholders.

Our VCaaS model enables corporations to maintain focus on core operations while building breakthrough innovation capabilities. We're not just facilitating transactions, we're architecting the future of corporate innovation.

Why This Matters Now

The companies that will define the next decade are being built today. We're not just predicting this transformation, we're actively creating it through strategic partnerships with forward-thinking corporations and breakthrough technology companies.

Our approach transcends traditional venture capital limitations by creating a new category of value creation. We're building bridges between corporate resources and entrepreneurial innovation, enabling both to achieve outcomes neither could reach alone.

Our Commitment Moving Forward

At Mandalore Partners, we're committed to leading this transformation in company building. We're creating exceptional value for entrepreneurs, corporations, and society at large by reimagining how strategic capital, operational expertise, and market access can be combined.

The future of company building belongs to those who can successfully navigate the intersection of technology, strategy, and execution. We're not just participants in this evolution, we're architects of it.

Final Thoughts

The venture capital industry is at a turning point, and Mandalore Partners is leading the way with a bold alternative to outdated, transactional investing. Through our Venture Capital as a Service (VCaaS) model, we combine the strategic resources of established corporations with the agility of innovative startups to create lasting value beyond traditional VC limitations. As markets demand quality, strategic depth, and sustainable growth, we’re building companies that leverage technology, industry expertise, and regulatory foresight to drive real impact. At Mandalore, we’re not just funding businesses, we’re designing the infrastructure for tomorrow’s economy. Join us to shape this transformation, not just react to it.