Active partnerships change the way fintech startups and insurtech startups grow. Simply providing capital no longer meets the complex needs founders face today. Mandalore Partners takes a hands-on role, offering operational support and strategic partnership that drive sustainable progress. This approach reshapes how venture capital can back startups beyond funding alone. Let’s explore how an active partnership can become a key asset for your venture’s long-term success.

The Power of Strategic Partnerships

In today's fast-paced tech world, partnerships are not just beneficial—they're essential. The right collaboration can propel startups to new heights.

Boosting Growth for Fintech Startups

Fintech startups need more than just funds to thrive. They require strategic partnerships that provide both financial support and expert guidance. Imagine having access to a network of seasoned professionals who can help navigate the complexities of finance and technology. This is where strategic partnerships shine. They offer fintech startups a chance to leverage expertise, helping them avoid common pitfalls and accelerate growth.

Take, for instance, a fintech startup that partnered with seasoned investors. Within a year, they doubled their client base. This success was driven by shared knowledge and resources. The right partnership can be the difference between stagnation and explosive growth. Learn more about these dynamics with insights from this white paper on fintech mergers.

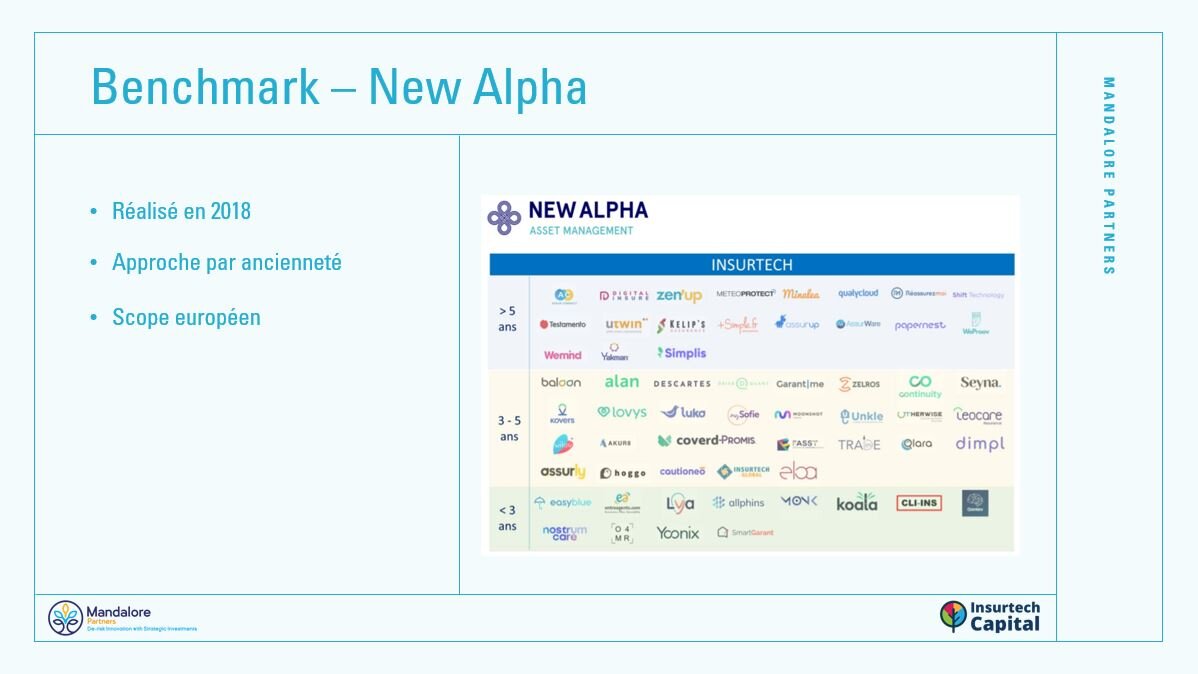

Enhancing Sustainability in Insurtech Startups

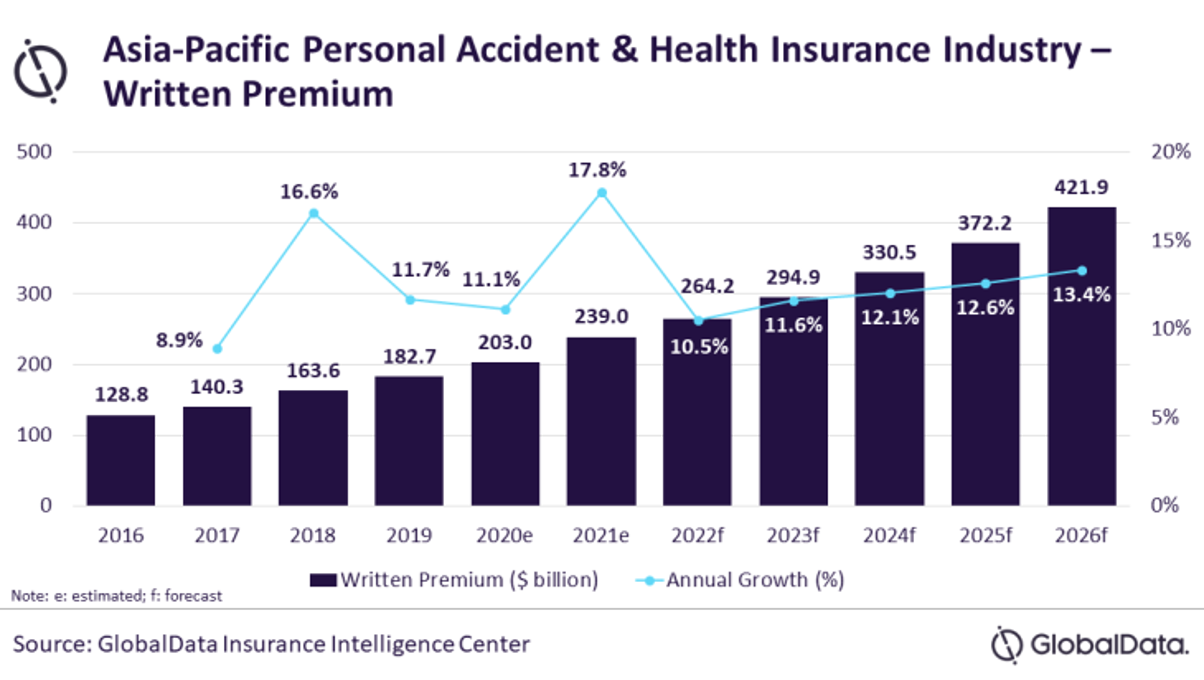

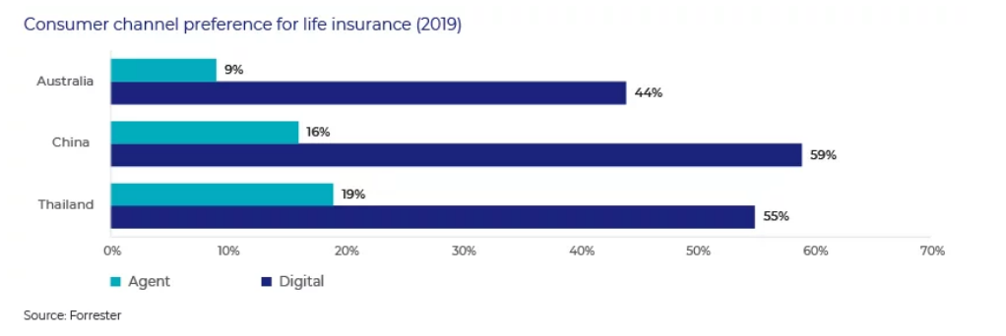

For insurtech startups, sustainability is a key concern. A strategic partnership can pave the way for lasting success. By collaborating with experts in the field, insurtech companies can develop robust strategies that ensure they stay competitive. This is crucial in a sector where regulations and consumer expectations constantly shift.

Consider an insurtech venture that partnered with industry veterans. This partnership allowed them to refine their product offerings, resulting in a 30% increase in customer retention. By aligning with experienced partners, insurtech startups can build a sustainable foundation that supports long-term growth. Want to explore more about the insurtech landscape? Visit this Columbus Insurtech Companies article.

Mandalore Partners' Hands-On Approach

At Mandalore Partners, the focus is on active involvement. This hands-on approach goes beyond traditional venture capital, offering startups a unique blend of resources and support.

Venture Capital and Operational Support

Venture capital at Mandalore Partners is not just about funding. It's about providing comprehensive operational support. Startups benefit from a team that assists with strategy, governance, and execution. This holistic approach ensures that companies are not only funded but also guided towards their goals.

Imagine having a partner that helps streamline operations and improves efficiency by 25%. This is the kind of support Mandalore offers. By being deeply involved in the day-to-day operations, Mandalore ensures that startups are equipped to handle challenges and seize opportunities. Discover more about Mandalore's impact on insurtech in this research article.

Building High-Impact Businesses

Building a high-impact business requires more than just a great idea. It demands strategic planning and execution. Mandalore Partners excels in helping startups transform their visions into reality. By focusing on impact, Mandalore ensures that businesses are not only profitable but also make a difference.

Consider a scenario where a startup, with Mandalore's guidance, expanded its market reach by 40% within two years. Such success stories highlight the importance of having a proactive partner in your corner. Mandalore's commitment to impact-driven ventures is evident in every partnership, ensuring that businesses are built to last.

Long-Term Success and Impact

The journey to long-term success is filled with challenges. However, with an active partnership, these challenges become manageable stepping stones to growth.

Navigating Challenges with Active Partnership

Active partnerships provide the support needed to navigate complex market landscapes. With Mandalore Partners, startups have a partner that is committed to their success. This means having access to solutions tailored to overcome specific industry challenges.

Most startups struggle with scaling, but with the right partnership, scaling becomes a strategic process. Mandalore's expertise allows startups to anticipate market shifts and adjust strategies accordingly, ensuring they stay ahead of the curve. Insights from field-specific studies, such as this one on the economy and finance, offer valuable perspectives on navigating industry challenges.

Scaling Efficiently with Mandalore Partners

Efficient scaling is crucial for any startup aiming for long-term success. Mandalore Partners provides the tools and insights necessary for startups to scale efficiently. By focusing on strategic growth, Mandalore ensures that startups expand their operations without compromising quality or vision.

Imagine achieving a 50% increase in operational capacity while maintaining customer satisfaction. This is the level of efficiency that an active partnership with Mandalore can achieve. With a focus on strategic scaling, startups can grow sustainably and profitably, ensuring long-term success and impact.

In conclusion, the right partnership can transform a startup's journey. By choosing to work with Mandalore Partners, fintech and insurtech startups pave the way for not only growth but also enduring success.

https://www.mandalorepartners.com/